tax shield formula excel

Since the interest rate is a semi-annual figure we must convert it to an annualized figure by multiplying it by two. It is 0320000004010410501101.

Interest Tax Shield Formula And Excel Calculator

By using the formula he gets.

. Depreciation Tax Shield 20000. How to calculate after tax salvage valueCORRECTION. To arrive at the after-tax cost of.

Tax Shield Deduction x Tax Rate. For instance if the. For example suppose you can depreciate the 30000.

Based on the information do the calculation of the tax shield enjoyed by the company. Interest Tax Shield Interest Expense Tax Rate. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

Operating Profit is calculated as. Pre-Tax Cost of Debt 28 x 2 56. The following is the Sum of Tax.

Calculating the tax shield can be simplified by using this formula. WACC 0583 45 0417 40 1 -32 WACC 376. Do the calculation of Tax Shield enjoyed by the company.

Calculate the present value PV of each interest tax shield amount by. The effect of a tax shield can be determined using a formula. In the line for the initial cost.

Tax rate debt load interest rate interest rate. Depreciation Tax Shield Depreciation Applicable Tax Rate. Depreciation Tax Shield 100000 20.

How to calculate tax shield due to depreciation. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted. Net Operating Profit After Tax NOPAT EBIT 1 Tax Rate EBIT is your gross profit minus the total operating expenses for the period and the OpEx line item can include items.

Based on the given information the WACC is 376 which is comfortably lower than the investment return of 55. PV of Tax Shield. Tax Yield Tax Free Yield 1 Tax Rate Or Tax Yield 6 1 40 Or Tax Yield 006 1 040 Or Tax Yield 006 060 01 10.

As such the shield is 8000000 x 10 x 35 280000. Tax Shield Value of Tax-Deductible Expense x Tax Rate. How to calculate NPV.

5 The fifth item is the PV of all the future tax shields from CCA assuming the equipment will last forever under the half-year rule. Multiply your tax rate by the deductible expense to calculate the size of your tax shield. This is equivalent to the 800000 interest expense multiplied by 35.

The present value of the interest tax shield is therefore calculated as. Or the concept may be applicable but have less. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

Multiply the interest expense by the tax rate assumptions to calculate the tax shield. The intuition here is that the company has an 800000. The tax shield formula is simple.

This is usually the deduction multiplied by the tax rate. This is equivalent to the 800000 interest expense multiplied by 35. As such the shield is 8000000 x 10 x 35 280000.

The intuition here is that the company has an.

Tax Shield Formula How To Calculate Tax Shield With Example

Adjusted Present Value Apv Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

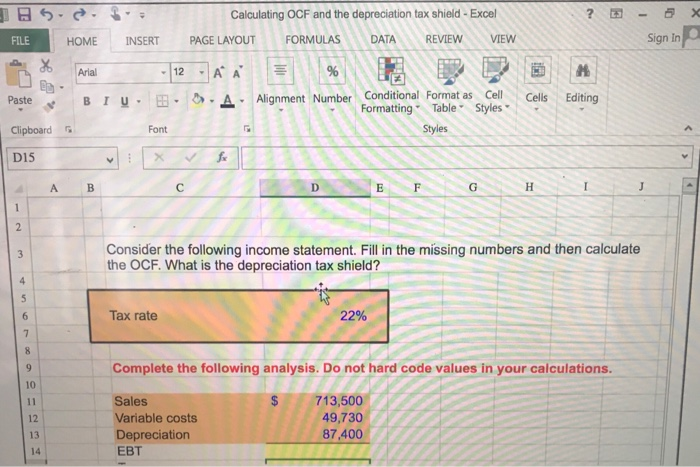

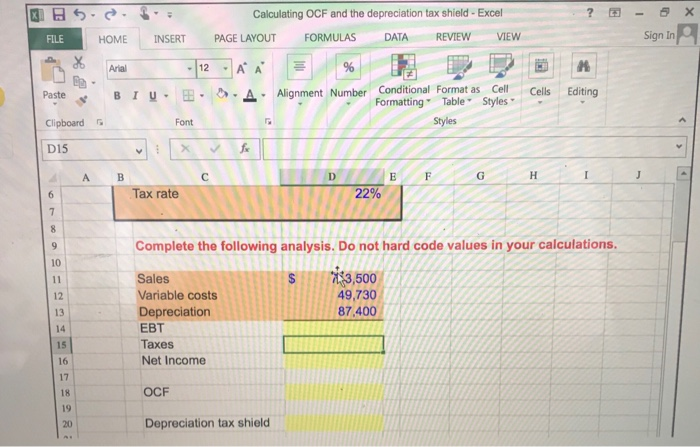

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

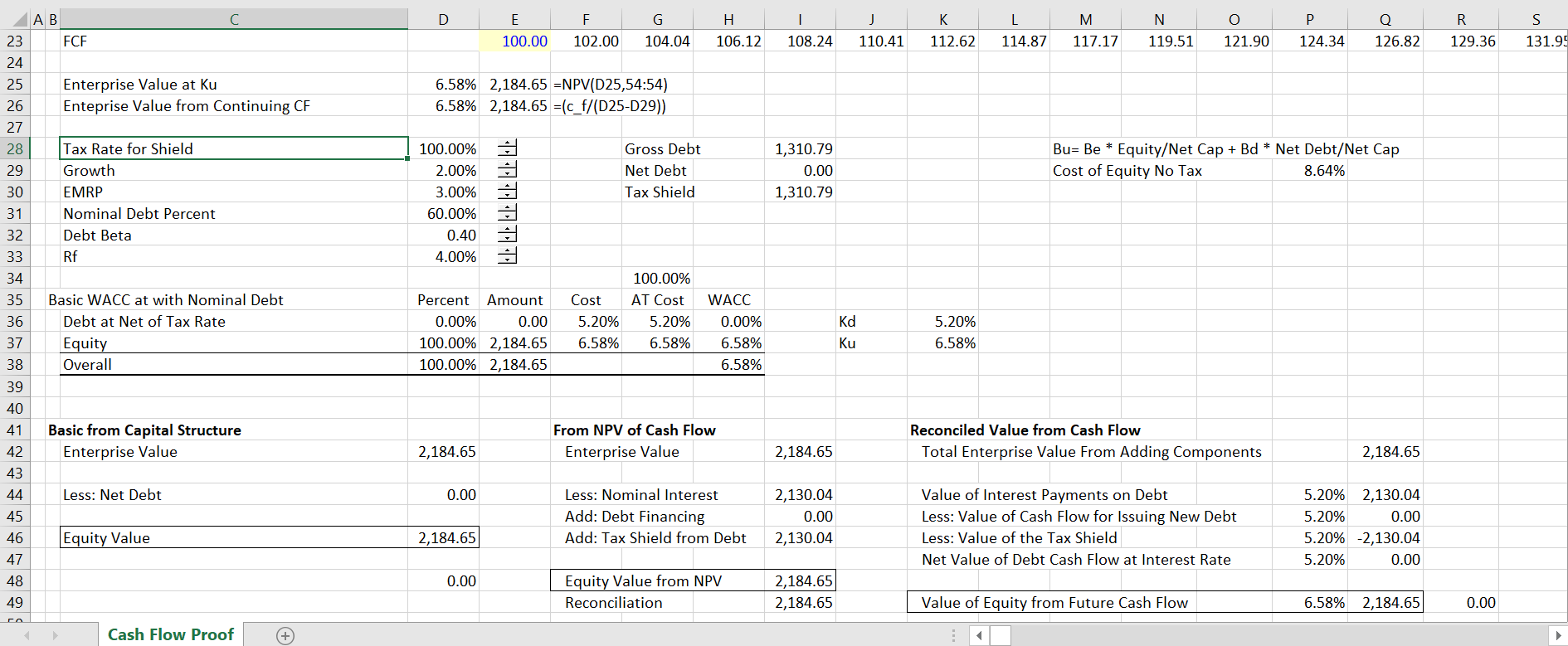

Wacc Formula Excel Overview Calculation And Example

Net Operating Profit After Tax Nopat Formula And Excel Calculator

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Complexities In Financial Modeling Excel Exposure

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples